Speed gives Australia an edge in Asia

Asparagus can be cut in the field in Australia and on sale in Japan 30 hours later. This second to none access to markets in Asia is one of Australia’s fortes and maximises the freshness, quality and shelf life of its spears. Via direct flights, the majority of the country’s asparagus exports not only reach countries such as Japan and Singapore fast, they benefit from minimal tariff restrictions. But Australia also faces challenges – such as the high cost of labour and of this rapid air freight – and it has just ended a “rollercoaster” of a season dogged by adverse weather, explains Australian Asparagus Council president Adrian Raffa.

Japanese now have yen for thicker Aussie spears

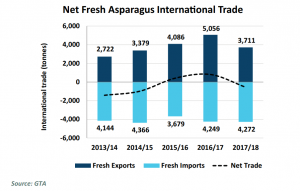

Asparagus is Australia’s second biggest fresh vegetable export, though it contributes just 1.8% of the total volume while carrots lead with 53.6%. The Southern Hemisphere grower is among the world’s top ten asparagus producers but ranks lower by area, arguably due to yields higher than the global average. The official figures are not yet in for Australia’s 2019/20 asparagus season, but ITC Trade Map data shows Australia exported 3,245 tons of fresh asparagus (HS code 070920) in the 2019 calendar year. Of that total, the lion’s share (70%) went to Japan, Singapore 7%, Taiwan 6.5%, Korea 6.3%, Hong Kong 5.6%, China 3% and Malaysia 1.3%. Raffa, who is also export coordinator at exporter Momack Produce, said around 50-60% of the spears for Japan are sent loose in 10kg wooden boxes, with 30-40% in the standard Japanese retail format of 100g barcoded and banded bunches. In Japan, the Australians usually ship to trading companies who onsell to retailers. The Aussie export season – usually mainly from about September to December – coincides with a time when there is still a lot of production in Japan and Taiwan despite being the counterseason. Raffa said Australia has managed to turn to its advantage something that 10 years ago was a problem – the fact that its spears have a much bigger diameter than the very skinny ones grown locally in these markets and imported from Mexico. Now, in both its domestic and export markets, consumers are learning to associate Australia’s thicker asparagus with a softer, juicier product with less fibre per spear. “We offer a different eating experience you can really only get from Australia,” he said.

High-end segment in China beckons

So far, Australia sells insignificant volumes to China (mainly Beijing and Shanghai) but the Asian giant is well on its radar because unlike other markets in the region, most of which are quite mature and saturated, “it is slowing transforming into more and more growth for Australian asparagus,” Raffa said. China has so many growing regions that it has domestic supply for much of the of year and a very low cost base compared to Australia’s high labour and air freight costs. “But if we can highlight our quality there’s a lot of potential in China’s retail channel,” he said.

Room for domestic demand to rise

According to the 2017/18 Australian Horticulture Statistics Handbook, only a third of Australian households bought asparagus in the year to June 2018, buying an average of 233 g of asparagus per shopping trip. The supply per capita was 326 g, based on the volume supplied. Raffa said consumption is growing but with plenty of room for more of this versatile vegetable in the Aussie diet. Fresh asparagus – 99% green – is marketed through central wholesale markets in all states of Australia and also sold direct to supermarkets and foodservice. Raffa said the standard retail format is now a 150g bunch with bands at the top and bottom. Many years ago it was 250 g but retail pressure to hit certain price points has seen it shrink. The national market predominantly prefers spears of 9-15 ml diameter.

Counter season imports from Mexico, Peru

Generally, about 60% of domestic asparagus production is consumed within Australia, with the local product usually available from August to December and then mid-January through to April. Over the Australian winter, when local asparagus is not available, imports arrive from Mexico mainly but also Peru and as of August 2019, both must undergo pre-shipment methyl bromide fumigation. Australia also imports small amounts from the US to meet seasonal and variety niches, and Thailand.

Imports generally arrive pre-packed for Australian specifications. Around 98% of Australia’s tonnage is grown in the south-eastern state of Victoria and the vast majority of it in Koo Wee Rup, which is known for its “black gold” – a unique and highly fertile black peat asparagus thrives in. Like the perfect ‘terroir’ for wine, this asparagus hub also has ideal air, water, climate and terrain for great quality spears. Mildura, in north-western Victoria, is the second-biggest production area and has a slightly earlier crop thanks to being an average 5C warmer. Compared to asparagus producers elsewhere in the world, Australia generally enjoys environmental benefits such as low chemical use and relative freedom from pests and diseases.

UC157F1 favoured for Australian farrows

There are typically two asparagus harvests: a spring cut, which supplies premium quality spears (known for their sweetness, Raffa says) mainly for the export market; and a summer cut, primarily destined for the domestic market. In Victoria, the spring harvest is usually from about August to late December (with peak availability in October). The summer cut runs from mid-January-mid April. By far the main variety is the high yield UC157F1, with Mildura also growing some Ida Lea. The asparagus is grown in raised beds which keep lots of water in the furrows during high rain periods in spring and the plants out of flooding. “The last season was quite a rollercoaster,” Raffa said. Very wet weather at the start of the 2019 spring season reduced volumes and Koo Wee Rup faced unprecedented amounts of cold weather and hailstorms in mid-October. All this combined with other adverse weather reduced volumes and created challenges in maintaining quality and reliability. On the positive side, the bushfires which razed many other regions over summer did not reach these areas though smoke haze made visibility quite low, he said. While it was once focused on canneries, competition from much-cheaper China has seen Australia predominantly supply fresh spears. And where once there were over 100 growers nationally, consolidation and farmer retirement has shrunk that to about 20. On the potential impact of the COVID-19 pandemic, Raffa said the Australian industry is very reliant on air freight exports and foreign workers. “The potential to be without either for the upcoming season is very concerning and we’re looking at ways to address that,” he said. Fresh Asp by country

Australia’s main asparagus growers & exporters

Momack Produce Pty Ltd: farmers, packers and exporters based in Koo Wee Rup, Victoria. Dispatches 7 days week from Melbourne airport. Supplies major wholesale markets and supermarkets including Coles and Woolworths across Australia via sister company Motta Produce.

T&G Vizzarri Farms Pty Ltd: also a Koo Wee Rup-based grower-packer-shipper, is the nation’s biggest asparagus producer and a supplier to Coles, Woolworths, Aldi and Costco.